How I Paid Off Over £10,000 of Debt in 2 Years: My Debt-Free Story

If you follow me on Instagram, you may have seen parts (or all) of my debt journey. A few people have asked how I managed to get out of debt, so I wanted to share my journey in more depth (after all, social platforms only show you a snippet of life).

Really, it comes down to changing my mindset. This is something I’m continually working on, and I’m all about progression rather than perfection!

If you dived into my backstory, it’s probably unsurprising that I ended up in debt. I’ve always been a spender rather than a saver. Until the age of 40, I had zero savings. And it was only when I moved in with my other half that I realised how much of a negative impact that would have on our future.

When our landlord decided to sell our rental home, I knew I had to get serious about my finances. Prices were starting to skyrocket, our bills were going up, and there was little disposable income left.

In just under two years, I managed to clear over £10,000 of debt by knuckling down, picking up a couple of side hustles, and considering the amount of interest on the money I owed.

Below, I’ll share my step-by-step process of how exactly I went about tackling the £10k debt in case it provides you with some inspiration to start your own debt-free journey.

Getting Real With Numbers

I’m going to be honest with you, I had no idea how much money I actually owed when I decided to pay off my debt.

I knew it was at least a couple of thousand pounds, but seeing the figure of £10134 was somewhat of a shock! After seeing those numbers, I became determined to take control of my finances and make a plan of action.

Realistically, I gave myself around two years to pay the debt off as I felt this was achievable without restricting my budget too much.

My tip: Face the numbers head-on. It can be daunting, but getting a clear picture of your debt is the first step to paying it off. Once you know where you stand, you can start making a solid plan.

Tracking My Spending to Find Out Where My Money Was Going

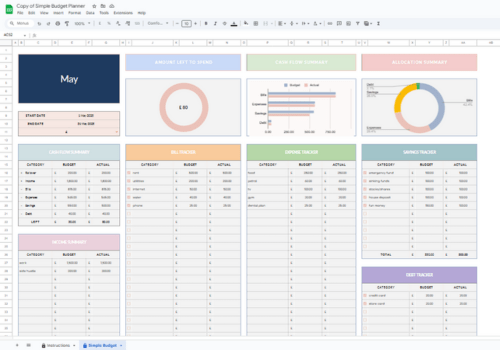

A spreadsheet can help you track where your money is going!

One of the biggest eye-openers for me during my debt-free journey was realising how much I was spending on… well, pretty much everything. I started tracking my outgoings to see where my money was going, and let me tell you, those little expenses add up fast.

It wasn’t big purchases I had a problem with, it was those little random supermarket visits, snacks, new clothes, subscriptions etc. Once I could see where I was overspending, I knew where I could easily cut back.

My tip: Track your spending. Even if it’s just for a month, note down every single purchase. You might be surprised at how much you’re spending on things you can live without (and it’s an easy way to find some extra cash to put towards your debt).

Following the Debt Snowball Method

There are several ways to pay off your debt – the good old fashioned paying it down as and when, the debt avalanche method and the debt snowball method (the latter two are methods by Dave Ramsey who I’m not overly familiar with but I liked the idea of the snowball method since a few of my debts were on the smaller side).

I went with the debt snowball method and it made such a difference. Basically, I started by paying off my smallest debt first while making minimum payments on the rest. Each time I crossed out a small debt, I felt like I’d scored a little win, and it gave me the motivation to keep going. After clearing the smallest one, I took what I was paying on that and added it to the next smallest debt, and so on.

My tip: Use the debt payoff method that’s right for you. Clearing smaller debts first gives you quick wins and that boost can help keep you on track for the bigger ones. But if you have high-interest debts, it may work out better for you to pay those first.

Switching to Interest-Free Credit Cards

One of my best money moves for reducing my debt was transferring my high-interest credit cards to interest-free balance transfer cards. In doing so, I wasn’t just chipping away at interest; I was paying down the debt itself. I chose cards with long interest-free periods, so I had time to make bigger payments without worrying about the interest being put back on. To prevent my credit score from decreasing, I did one balance transfer at a time within a 6 month period (I only did three overall, but it made a massive difference!)

My tip: Consider interest-free balance transfers. Just check for any balance transfer fees and know when the interest-free period ends. It’s a great way to focus on paying off the actual debt instead of just keeping up with interest. Don’t do more than one in a short period of time if your credit score is something you’re worried about!

Budgeting, Living Below My Means, and Still Having Fun

Budgeting has been a game-changer. After tracking where every pound was going, I created a budget that helped me to make more than the minimum payment on my debts, as well as put money aside for treats.

I knew I couldn’t just cut out all the fun stuff, so a little “fun money” each month meant I could still treat myself to something small without feeling guilty.

My tip: Make a budget, but don’t make it so strict that you’re miserable. Tracking your spending can help you spot where to save, and allowing yourself some fun money can create a balance between living life and getting your finances sorted.

Earning a Bit Extra with Small Side Hustles

To speed things up, I found ways to earn a little extra cash. I sold stuff on Vinted, did a small amount of matched betting, a few surveys, and some market research. I didn’t make huge sums of money, but the extra went straight towards paying off my debt.

My tip: Try doing a side hustle. Even if it’s just a few extra pounds a week, it can make a big difference.

Getting a Pay Rise and Making Tough Choices

During my debt-free journey, I was lucky enough to get a pay rise at work. Instead of splurging (even though I was mega tempted!), I stuck to my original plan and used the extra income to make larger payments off my debt.

Towards the end of my journey, I made a tough decision to sell my car. I realised I could manage without it for a short time, and selling it allowed me to clear the last chunk of debt. Plus, I had a bit left over to start building up my house deposit fund, which felt amazing!

My tip: Make the most of any income boosts. Whether it’s a pay rise, a bonus, or selling unused items, it can speed up the debt payoff process.

Staying Accountable with My Finance Instagram Account

One of the best things I did was start a finance-focused Instagram account. I started off anonymously, just sharing my progress, goals, and little wins here and there. At first, I wasn’t sure how much I wanted to share with the world so I kept it pretty low-key. But as I started to pay off my debt, I felt more confident and decided to share a photo of myself in my profile image.

The personal finance community on Instagram is so welcoming and supportive. That made a huge difference because I felt like I was in a safe space to share my progress, setbacks, and small victories. Posting updates kept me accountable, and knowing I wasn’t alone in this journey was incredibly motivating.

My tip: Find a way to keep yourself accountable. Whether it’s a social media account, joining a group, or even telling friends and family about your goals, accountability can make all the difference. If you’re feeling shy, starting an anonymous social account is completely okay!

Paying off £10,000 of debt wasn’t easy. The hardest part for me was having patience, but it was absolutely worth it.

If you’re working on paying off debt, I hope my story helps you see that it is possible. Every little step counts, regardless of the amount of money you need to pay off.

Now that I’m debt-free, I’m focusing on building up my savings, investing for the future, and working toward my next big goal: a house deposit.

If this post resonated with you, you may find my other posts helpful. I share personal finance tips on budgeting, saving, and making money, all with a realistic, judgment-free approach.